Parent Information

There are several different entitlements available for parents in England, which have different eligibility criteria. These are set out below.

Working parents’ entitlement

Child’s age: From the term after they turn 9 months until they start school.

Eligibility: For working parents -explained here

What you can receive: 15 hours per week over 38 weeks of the year. Can be combined with the universal

entitlement for 3-and 4-year-olds to make up 30 hours.

How to apply: Speak to your chosen childcare provider about if they can offer a place.

You apply online here on Gov.uk.

For parents of 2-year-olds receiving some additional forms of government support

Child’s age: From the term after they turn 2- years-old

Eligibility: Explained here

What you can receive: 15 hours per week over 38 weeks of the year.

How to apply: Speak to your chosen childcare provider about if they can offer a place. Speak to your local

authority about free childcare places for eligible two year olds. You may be able to find advice online on

your local authority’s website.

Universal entitlement for 3- and 4- year-olds

Child’s age: From the term after they turn 3- years old through to starting school

Eligibility: All 3- and 4- year-olds are eligible

What you can receive: 15 hours per week over 38 weeks of the year. Can be combined with the working

parents entitlement to make up 30 hours.

How to apply: Speak to your chosen childcare provider about if they can offer a place, and take them

your child’s birth certificate

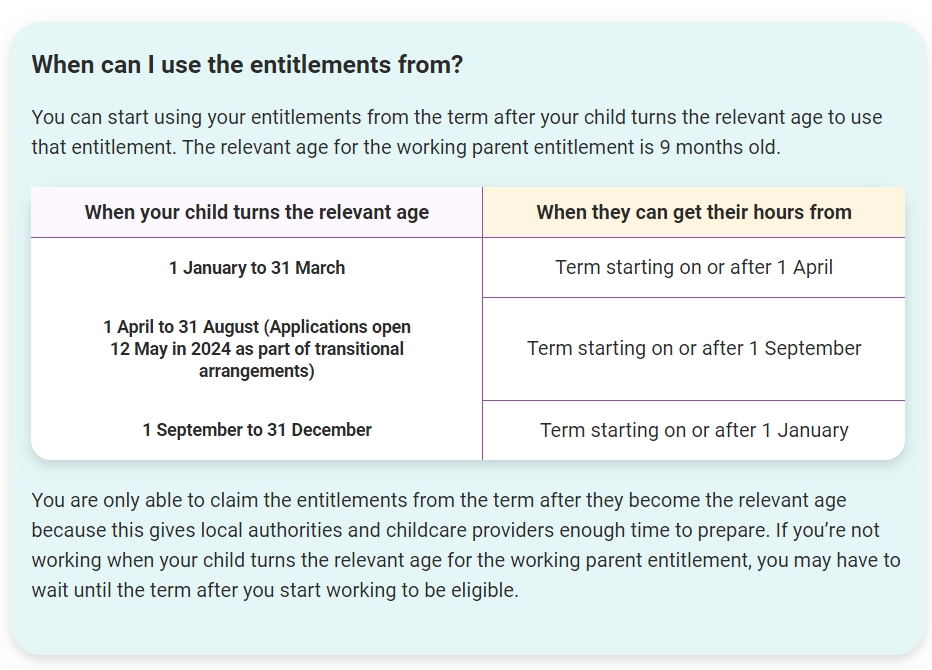

You are only able to claim the entitlements from the term after they become the relevant age because this gives local authorities and childcare providers enough time to prepare. If you’re not working when your child turns the relevant age for the working parent entitlement, you may have to wait until the term after you start working to be eligible.

How do I apply for the working parents entitlement?

You apply online here on Gov.uk.

You’ll need to make sure you have the following information to hand before starting the application:

- your national insurance number (or unique taxpayer reference if you are selfemployed).

- the date you started or are due to start work.

- details of any government support or benefits you receive.

- the UK birth certificate reference number (if you have one) for your child.

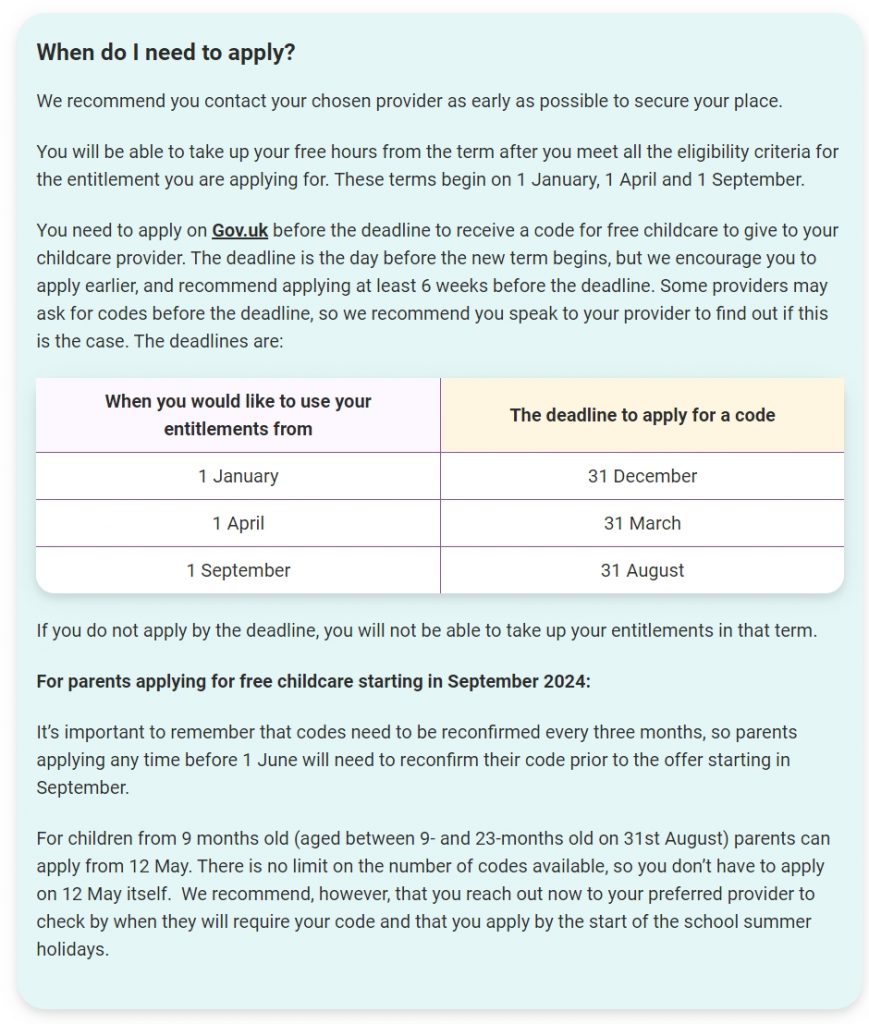

For children from 9 months old (aged between 9- and 23-months old on 31st August) parents can apply from 12 May to receive 15 hours childcare starting from September 2024. We have ensured the HMRC helplines will be open on 12 May if you choose to apply then and experience any difficulties.

If you are a foster carer, there is a separate application process. Speak to your social worker to find out more.

When do I need to apply?

We recommend you contact your chosen provider as early as possible to secure your place.

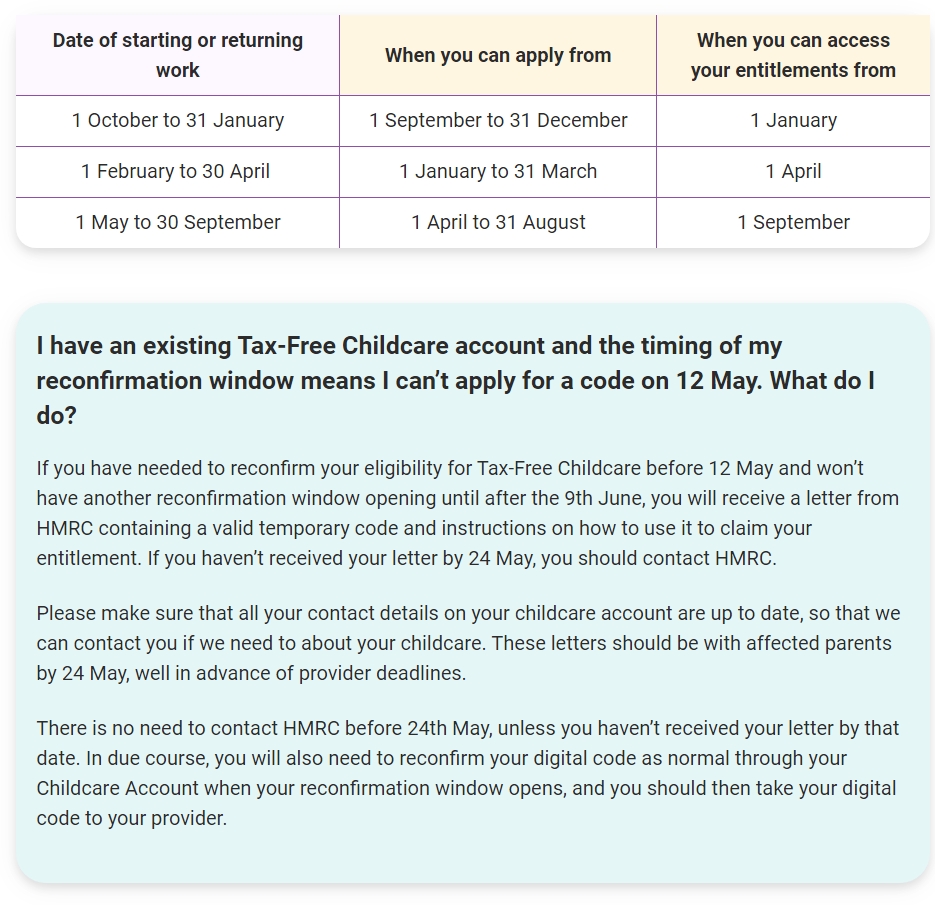

You will be able to take up your free hours from the term after you meet all the eligibility criteria for the entitlement you are applying for. These terms begin on 1 January, 1 April and 1 September.

You need to apply on Gov.uk before the deadline to receive a code for free childcare to give to your childcare provider. The deadline is the day before the new term begins, but we encourage you to apply earlier, and recommend applying at least 6 weeks before the deadline. Some providers may ask for codes before the deadline, so we recommend you speak to your provider to find out if this is the case. The deadlines are:

When will I find out if I am eligible?

When you apply you may find out if you’re eligible straight away, but it can take longer if you need to provide further information. Once your application has been approved, you’ll get a code for free childcare to give to your childcare provider.

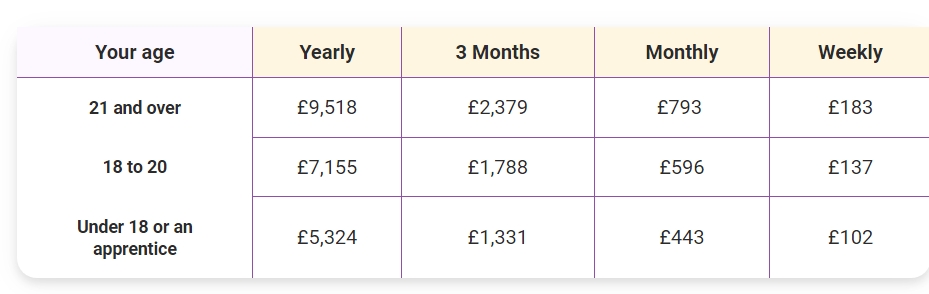

You can earn up to £100,000 adjusted net income per year and be eligible. If you have a partner who lives with you, they must also earn between these two amounts. The £100,000 adjusted net income level was chosen to correspond with income tax thresholds. See our eligibility criteria for more information, including the income requirements for those who are self-employed.

Can I apply for a code whilst I am on maternity, paternity or adoption leave?

If you are applying for childcare for an older child, who is not the subject of the parental leave, you can apply as normal.

You can also apply for the child that is the subject of the parental leave, though when you return to work will affect when you can take up the childcare. If you plan to return to work from parental leave or start a new job by the end of September 2024, you can apply for a free childcare code from 12 May at the same time as everyone else.

Parents in this situation will need to apply online as normal but will then receive a letter in the post within 1 to 2 weeks, enabling them to access their entitlement.

From 1st October, the below dates will apply:

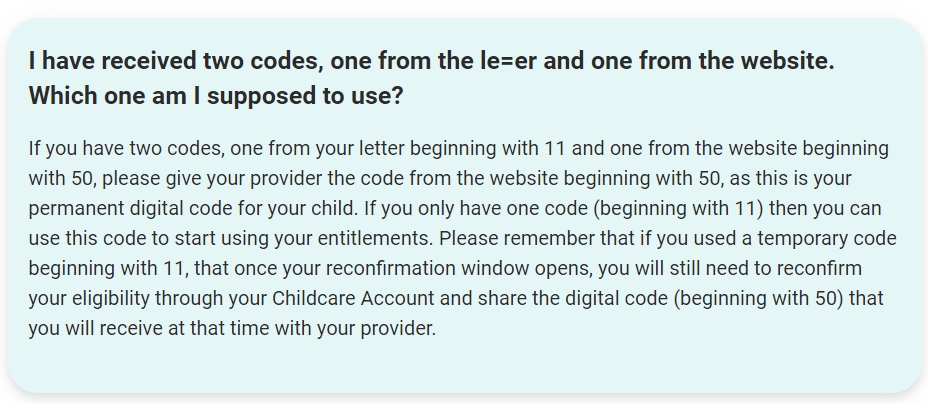

What if my reconfirmation window opens before the 9th June?

Some parents with existing Tax-Free Childcare accounts may have reconfirmation windows opening before 9th June. If this is you, you will not receive a letter as your reconfirmation window will open in good time for you to register for a code digitally and give it to your provider. We’re confident that all parents will be able to get codes by the time they need them, and there is no limit on the number of codes available.

If I’m eligible for Universal Credit can I get the new entitlements?

Yes, if you meet the eligibility criteria. Whilst you cannot claim Universal Credit and Tax-Free Childcare at the same time, those on Universal Credit will still be able to claim the working parents entitlement, as long as they meet the eligibility criteria.

This will not affect your ability to claim Universal Credit. If you are taking up more than 15 hours childcare (or 30 hours if you are also using the universal entitlement), you can claim Universal Credit Childcare, which can support you with up to 85% of the cost of additional childcare you pay for outside your entitlement to 15 hours. Please see the Universal Credit childcare costs page for more information.

Alternatively, there is a separate entitlement which means that parents of 2 year olds who are already receiving some additional forms of government support, such as Universal Credit or tax credits, can receive 15 hours of early education, including childcare. This is separate from the new entitlement for working parents.

All parents regardless of employment status, family circumstances, or income levels are eligible for the universal 15 hours for 3- and 4-year-olds.

Will I be reminded to reconfirm my details?

Yes, you will receive a reminder:

- when your reconfirmation window opens

- a week before your reconfirmation deadline

- and on your reconfirmation deadline.

This message will come from HMRC. Please remember to make sure that your details are up to date.

How do I log into my childcare account to reconfirm?

You need to log into your childcare account using your Government Gateway ID to reconfirm. The dates between which you should reconfirm will be displayed when you log in.

What if the provider I want to use says they don’t have a place available?

If your chosen provider doesn’t have a place available, we advise that you explore other providers in your local area.

Your local authority can provide support with finding a free place in your area.

Eligibility – Working Parents Entitlement

What if I am a student?

Students who work in addition to studying are eligible for this entitlement if they meet the income requirements.

Students who do not work are not eligible, but other schemes are available for those in further or higher education. If you’re a full-time student, you may be eligible for help with your childcare costs. Further information can be found at: https://www.gov.uk/help-with-childcare-costs/support-while-you-study

What are the immigration requirements for the parents?

You must have a national insurance number to apply. If you have a partner who lives with you, they must also have a national insurance number. If you are the parent who is making the application you must have at least one of the following:

- British or Irish citizenship

- Settled or pre-settled status, or you have applied and you’re waiting for a

decision. - Permission to access public funds – your UK residence card will tell you if you

can’t do this.

Using the working parent entitlements

What do the entitlements cover?

Government funding is to deliver your 15 or 30 hours of free, high quality, flexible childcare. It does not cover additional hours, activities or extra costs, such as meals. Your provider should provide invoices and receipts that are clear, transparent and itemised to see you have received your child’s free entitlements and understand any fees for additional hours or services.

You may have to pay for, or provide your own:

- Meals

- Other consumables, like nappies

- Additional hours

- Additional services or activities, like trips.

However, charges for consumables or additional hours should not be made a condition of accessing a free place.

You should not be charged:

- A top-up fee

- A non-refundable registration fee.

You may wish to speak to your local authority or your provider about any additional charges on top of the funded childcare hours, including any alternative options they offer.

Can I use the entitlements for a nanny?

No, you are not able to use the entitlements for a nanny or a home carer.

Reconfirming your eligibility for the working parents entitlement

Can I add another child to my account between reconfirmation windows?

Yes, a parent who is already using the childcare service for another child can add a new child to their account at any time.

When can I submit a new application if I missed my reconfirmation window or fell out of eligibility?

You can submit a new application any time you meet the eligibility criteria for childcare entitlements or Tax-Free Childcare. You must then present your code to your provider to confirm your place can continue.

Entitlement for parents of 2-year-olds receiving some additional forms of government support

What forms of government support make me eligible for this entitlement?

Your 2-year-old can get free childcare if you live in England and get any of the following benefits:

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Universal Credit, and your household income is £15,400 a year or less after tax, not including benefit payments

- The guaranteed element of Pension Credit

- Child Tax Credit, Working Tax Credit (or both), and your household income is £16,190 a year or less before tax

- The Working Tax Credit 4-week run on (the payment you get when you stop qualifying for Working Tax Credit)

You can also apply for this entitlement if your 2-year old:

- is looked after by a local authority

- has an education, health and care (EHC) plan

- gets Disability Living Allowance

- has left care under an adoption order, special guardianship order or a child arrangements order What about if I am not a UK citizen and have no recourse to public funds?

- Some households that have no recourse to public funds may be eligible for this entitlement for their 2-year-old. Please see this page for more information

What if I’m eligible for two entitlements?

You cannot use the working parents entitlement and the entitlement for families receiving some additional forms of support at the same time for the same child. Families of 2-year-olds who meet the eligibility criteria for both offers should apply only for the entitlement for families receiving some additional forms of government support, which avoids the need to reconfirm entitlement every 3 months. This will change in September 2025, when the working parent entitlement expands to 30 hours. Parents of two year olds who are eligible for both entitlements will be able to claim 15 hours from each entitlement.

Universal 15 hours for all 3- & 4-year-olds

What can I get in the universal entitlement?

All those aged 3 to starting school in England can get 570 free hours per year through this entitlement. It’s usually taken as 15 hours a week for 38 weeks of the year, but you can choose to take fewer hours over more weeks if your childcare provider offers this option.

When can I use this entitlement?

You can get it from the 1 January, 1 April or 1 September after your child’s 3rd birthday.

Contact your childcare provider or local council to find out more.

Can I combine the universal entitlement with the working parents entitlement to receive 30 hours of childcare?

Yes.

Support you can use along with your entitlements

What other support is available?

You can also apply for Tax-Free Childcare or Universal Credit childcare. You cannot use both of these at the same time.

What is Universal Credit childcare?

Universal Credit can help with the costs of childcare. You may be able to claim up to 85 per cent of your childcare costs if you’re eligible for Universal Credit and meet some additional conditions.

Is there any support I can get for my provider to help my child?

Yes. The Early Years Pupil Premium is additional funding for your provider to support children whose families get certain benefits. Its purpose is to enhance learning and development support for children, ultimately improving their outcomes. You can find out more about this on this page: Get extra funding for your early years provider.

The government is offering help for households. Check what cost of living support you could be eligible for at gov.uk/helpforhouseholds